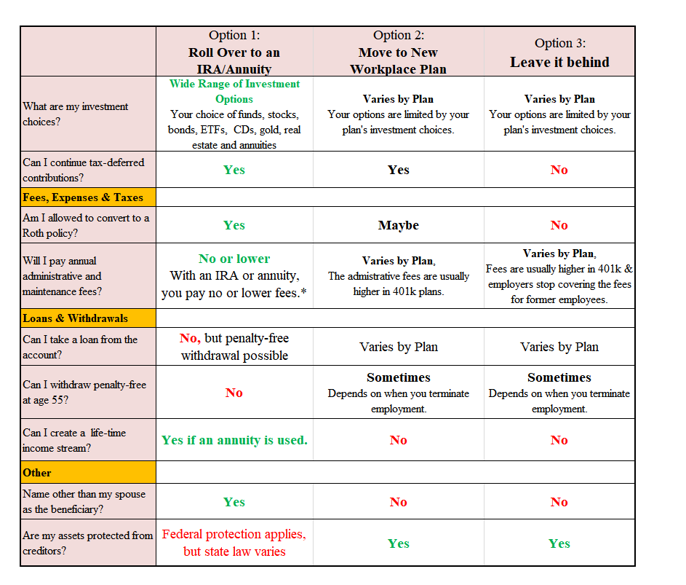

You have 4 options for your old 401(K):When you change jobs, you have several options with your 401(k) account. You can: (1) cash it out, (2) leave it where it is, (3) transfer it into your new employer's 401(k) plan (if one exists), (4) or roll it over into an IRA or an annuity for the principal guarantee and/or lifetime income. Forget about cashing it out—taxes and other penalties are likely to be huge. In the table below, we compare the pros and cons of the other three options. For most people, rolling over a 401(k) or 403(b) into an IRA is the best choice. In the table below, we compare the 3 options for your old 401(k): Benefits of rolling over 401(k) into an IRA:

1. More investment options: In your 401(k), you have the choice of a few mutual funds—mostly equity funds and a bond fund or two—and that's it. However, with an IRA, most types of investments are available to you, not just mutual funds, but also individual stocks, bonds, and exchange-traded funds (ETFs), to name just a few. You can even invest in real estate, precious metals, and annuities. 2. Lower Fees and Costs: Aside from the investment fees that are paid by employees, employers can choose to pay the administrative, fiduciary, and consulting fees. This portion of fees can be around 0.45%. But when you are not working there anymore, the employer will not cover these fees. 3. The Roth Option: An IRA rollover opens up the possibility of a Roth account. With Roth IRAs, you pay taxes on the funds you contribute, but then there is no tax due when you withdraw them. Nor do you have to take RMDs at age 72. 5. Estate Planning Advantages: Upon your death, there's a good chance that your 401(k) will be paid in one lump sum to your beneficiary, which could cause income and inheritance tax headaches. 6. Name family members other than the spouse as your beneficiary: If you are married, federal law says your spouse* is automatically the beneficiary of your 401(k) or other pension plans, period. putting a spouse down for less than 50% triggers the need for a spousal waiver. Additional benefits of rolling 401(k) into an annuity:

Please click the link below to watch a video created by Tom Hegna, best-selling author, and retirement expert. He explained the benefit of an FIA in this YouTube video titled "Just In Case Retirement": https://www.youtube.com/watch?v=tgIKJ5l8HWs Meet Merry and her husband:Before they retired, both Merry and her husband were engineers and had steady paychecks. Knowing that each month they would get several thousand dollars in their bank to cover the mortgage, insurances and other bills, they felt secure and peaceful. 10 years ago, when they turned 60, they decided to turn a portion of their savings into steady retirement paychecks. They rolled over $500,000 of their 401(k) to an FIA with a lifetime income rider. Let's look at their income sources today: From Social security: $4000 per month Pension payouts: $2000 per month Annuity payouts: $4000 per month ---------------------------------------- Total income: $10,000 per month Regardless of how bad the economy is, how many percent the market has lost, or whoever is the president, Merry and her husband will keep receiving at least $10,000 each month for the rest of their life. In addition, they also own long-term care insurance policies to make sure they can afford to hire a caregiver if they can't perform some daily living activities. No wonder this couple always has a good spirit. No wonder the 74-year old Merry looks like a 54-year old! Are there any downsides of doing a 401(k) rollover? 1.You may lose a special tax advantage: If you leave your job in or after the year you reach age 55 and think you'll start withdrawing funds before turning 59½; the withdrawals will be penalty-free. 2. Less robust legal protection: In case of bankruptcy or lawsuits, 401(k)s are subject to protection from creditors by federal law. IRAs are less well-shielded; it depends on state laws. 3. If you heavily invest in company stock You may want to transfer the shares out of your 401(k), and pay only the current capital gains rate on the NUA (net unrealized appreciation), rather than the income tax rate you'd pay were they held in an IRA. 4. You can't take loans from an IRA: You can borrow from your 401(k), which isn't possible with an IRA. But IRAs allow early withdrawals without the penalty under some conditions. How to rollover a 401k?Step 1. Choose which type of IRA/Annuity account to open If you do a rollover to a Roth IRA, you’ll owe taxes on the rolled amount. If you do a rollover to a traditional IRA, the taxes are deferred. Annuities offer one benefit that no other financial product offers. You may consider rolling over some of your retirement savings into an annuity that will eventually provide guaranteed, secure lifetime income. Step 2. Open your new IRA/annuity account Step 3. Ask your 401(k) plan for a direct rollover These two words — "direct rollover" — are important: They mean the 401(k) plan cuts a check directly to your new IRA /annuity account, not to you personally. If your 401(k) company cut a check to you, make sure to put that fund into the new IRA/annuity account within 60 days. --------------------------------- Thank you for reading this article. If you need help or have questions, please contact us at 713-277-5353 or https://t.me/AprilDeng. If you like this article, please subscribe to my Telegram channel: https://t.me/joinchat/AAAAAFYLQCx6KIXjOxj52Q |

Categories

All

Archives

August 2023

|

|